24Trades seems to be another typical boiler room. The firm has never disclosed its owner or legal jurisdiction, not to mention any regulations. Read our 24Trades review to find out all the details.

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | 24trades.io |

| Blacklisted as a Scam by: | N/A |

| Owned by: | N/A |

| Headquarters Country: | N/A |

| Foundation year: | 2022 |

| Supported Platforms: | WebTrader |

| Minimum Deposit: | 250 EUR |

| Cryptocurrencies: | Available |

| Types of Assets: | FX, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | No |

| Accepts US clients: | No |

What about the 24Trades Regulation?

In the About Us section, 24Trades claims to be owned by 24Trades Financial Group, based in Switzerland. However, this firm doesn’t exist. To provide financial services from Switzerland, the broker ought to have a FINMA license, which is one of the firmest regulations. Thus, we highly suspect that 24Trades even bothered to apply.

Why Is It Important For A Broker To Be Licensed?

Every investment firm has to be regulated and controlled by a higher authority. Similar to banks, insurance companies, and other financial institutions, brokers need someone to supervise their activities and ensure that the business is done accordingly.

Since 24Trades is allegedly based in Switzerland, it should have FINMA regulation. However, as the company owner is false, not surprising to learn that FINMA has never issued a license to 24Trades or 24Trades Financial Group.

In furthermore to the foregoing, we definitely advise you not to invest in the fake brokers FiboTraders, CapitalCore, and Arkcoin.

Traders Reviews About 24Trades

24Trades have mainly negative reviews. Clients describe everything they go through with this fraudulent firm. For instance, the broker prompts clients to pay money in advance for alleged fees and taxes so that the withdrawal request would be approved. Yet, even upon paying, clients never saw a penny back.

How Reliable Is 24Trades Broker?

24Trades is a scam brokerage. The firm hasn’t disclosed any basic information about headquarters and legal jurisdiction. It’s a well-known boiler room you should avoid at all costs.

What Platforms Does 24Trades Offer? – Available Trade Software

Clients can trade on the 24Trades proprietary WebTrader. Many shady firms offer this same software, and there’s nothing special about it. Besides basic functions such as trading asset view and several charts and indicators, this platform has nothing.

If you want to start trading, ensure you find a legitimate broker with MT4 or MT5. This investment platform offers many trading tools and provides funds security.

All About 24Trades Accounts

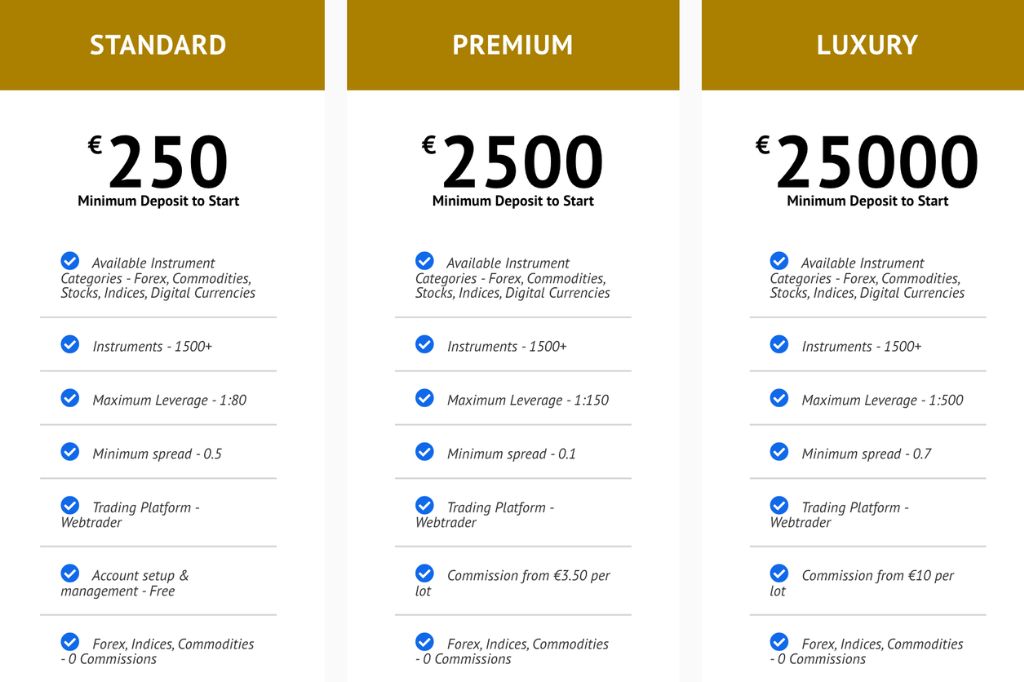

Here’s a trading account overview if you’re still interested in trading with 24Trades.

Accounts differ in spread, leverage, commissions, and customer service availability.

24Trades Broker – Countries Of Service

According to our research, the 24Trades trading scheme is mainly active in:

- Canada

- UK

- Germany

- Austria

24Trades Range of Trading Instruments & Markets

The broker offers trading on all 5 major markets, including:

- Currency pairs – EUR/USD, GBP/USD

- Commodities – gold, oil, sugar

- Indices – NASDAQ, Dow Jones

- Shares – Amazon, Google

- Cryptocurrencies – BTC, XRP, ETH

Besides, noted the names of the Trade Union, Strategic FX and Fin Venture trading scams and avoid them at all costs! By the same token, always analyze the background of online trading companies before investing!

24Trades Minimum Deposit

The company requires a pretty standard initial deposit of 250 EUR. However, many legitimate firms have Micro accounts starting with as low as $10. Thus, there’s no reason to risk 250 EUR with a shady illicit firm when you can test the system and your skill with a safe broker and a lower minimum deposit.

Scam Bonus Policy – As A Way To Keep Your Money

If you accept any 24Trades bonuses, you’ll have to comply with the malicious Bonus Policy. According to it, a client cannot submit a withdrawal request before reaching a rollover of 25 times the deposit plus the bonus amount.

This clause was made to prevent customers from getting a payout. Besides, many will invest more funds to reach a rollover sooner, but even then, they’ll not see their money back. This scam firm will simply come up with a new reason not to approve a withdrawal request.

24Trades Unfavorable Trading Conditions

As’s the case with many scammers, 24Trades has unfavorable trading conditions as well.

Leverage and Spread

While EU and UK regulators have set a leverage limit of 1:30 for the Forex market and only 1:2 for crypto, 24Trades provides up to 1:500.

The spread starts at 0.1 pips, and there are no commissions. Since the broker has no legitimate way to earn money, it’s clear that their utmost goal is your entire deposit.

24Trades Deposit, Withdrawal Methods, and Fees

The firm accepts the following payment methods:

- Debit/credit cards

- E-wallets

- Bank transfer

- Cryptocurrencies

However, there are some hefty withdrawal fees. For instance, you’ll have to pay 50 units for each bank transfer withdrawal and 25 units for cards and e-wallets. On top, there’s an additional $10 processing fee for the latest method.

Cryptocurrency Deposit Risk

If you want to deposit via crypto, it comes with certain risks. Crypto wallets are anonymous and transactions are encrypted. If you want to reverse the transaction later, it’s quite challenging. That’s why scam brokers are exploiting this payment method often.

We always advise investing with your credit card as you’re entitled to a chargeback within 540 days.

Scammed by 24Trades Broker? – Let Us Hear Your Story

If you were scammed by 24Trades, let us know. Our chargeback specialists may be able to assist and help you get your money back.

But What Is A Chargeback?

This is a way for your bank to recover funds directly from the merchant. Contact us via online chat to book a free consultation; tell us your story, and let’s start the procedure before it’s too late.