A brief overview of Bullden broker’s website showed what we already suspected. We know nothing about the owner or legal jurisdiction, not to mention the trading license. Simply put, this particular brokerage is another anonymous financial swindler with the utmost goal of stealing clients’ funds.

This detailed Bullden review will show you everything you need to know and ensure you will not fall for their fairytales.

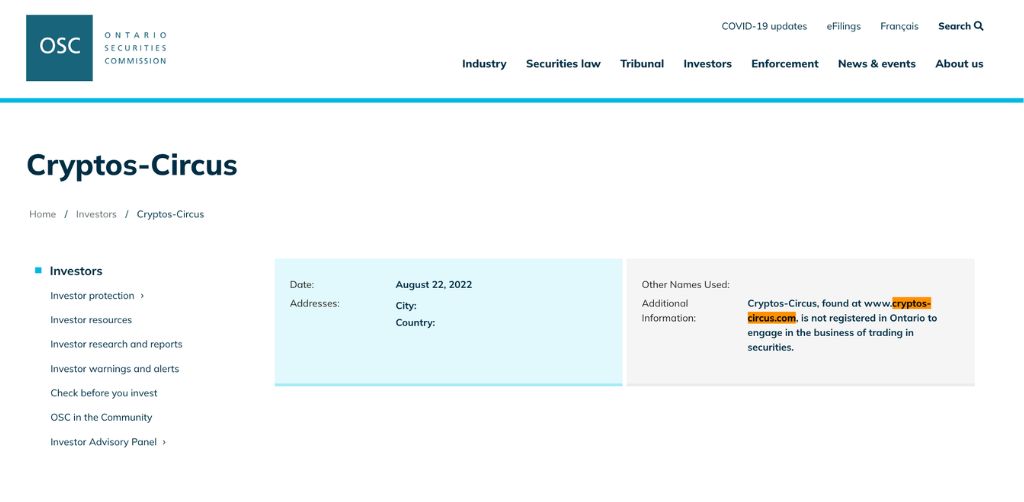

Additionally, we strongly advise you to avoid the fraudulent brokers Cryptos Circus, MilleniumOne, and AlfaBTC.

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | bullden.io |

| Blacklisted as a Scam by: | FSMA, AMF Quebec |

| Owned by: | N/A |

| Headquarters Country: | N/A |

| Foundation year: | 2022 |

| Supported Platforms: | WebTrader |

| Minimum Deposit: | 0 USD |

| Cryptocurrencies: | Available – BTC, LTC, BNB |

| Types of Assets: | Forex, stocks, commodities, indices, shares |

| Maximum Leverage: | 1:100 |

| Free Demo Account: | No |

| Accepts US clients: | Yes |

Is Bullden a Trustworthy And Licensed Broker?

As aforementioned, Bullden is an entirely anonymous website. The company provides Forex and CFD trading, but that’s all we know. No official owner would take responsibility for the broker’s activities, and there’s no mention of legal jurisdiction.

Upon checking registers of Tier1 license providers, such as FCA, ASIC, BaFin, and CONSOB, we found nothing. All this is a clear indicator that Bullden cannot be trusted due to a lack of license.

Reasons Not to Trust an Unlicensed Broker

Unlicensed brokers can vanish whenever they like. If you try to file a complaint, no regulator will take responsibility. Since we don’t know where the official headquarters are, legal actions are hard to take.

Legitimate brokers require Forex providers to form significant compensation funds and secure clients’ money by keeping it in segregated accounts. That’s something you won’t find with scheme firms like Bullden here.

So Is Bullden a Decent Broker or a Scam?

Bullden is an anonymous, unregulated trading firm. The company has been blacklisted by the Belgian regulator FSMA and the Canadian AMF of Quebec.

Warnings From Financial Regulators

Bullden trading scam was exposed by two official financial regulators – Belgian FSMA and the Canadian AMF.

FSMA instructed Belgian citizens to avoid Bullden as it was a fraudulent trading website. Similarly, AMF stated that bullden.io is an unlicensed domain, and citizens shouldn’t trust it with their funds.

What Do Traders Think Of Bullden?

The short answer would be nothing good. Customers are not satisfied with the level of service, trading platform, and of course, inability to withdraw their funds.

While everything will seem amazing initially, and you may even see your trading account growing, things will change when you submit a withdrawal request. According to reviews, this is when your trading account will be suspended, and the broker will deny any further contact.

Bullden Offer WebTrader Platform? – Available Trade Software

Bullden offers a decent-looking WebTrader with somewhat advanced functionalities. You’ll find pending orders, Stop Loss and Take Profit, which can really come in handy.

However, the real issue is not the quality but the broker’s manipulations. When the trading firm owns the platform, they have access to it from the back side, being able to change market prices. Thus, depending on their end goal, they can make it look like you earned enormous profits or lost everything you invested.

Instead of risking so much, find a legit broker offering reliable trading software such as MT4 or MT5.

Bullden Accounts Overview

Bullden has six account types on offer. These are:

- Main – $0

- Bronze – $2,500

- Silver – $10,000

- Gold – $25,000

- Platinum – $50,000

- VIP – $100,000

Besides the minimum and maximum lot sizes for different assets, we see no other benefits.

Bullden Broker – Countries Of Service

The majority of complaints about Bullden services come from:

- France

- Canada

- Belgium

- Netherlands

- UK

Also, avoid the trading frauds Europa Trade Capital, SinaraCorp, and FinLibra at all costs! Moreover, before investing, always look into the past of internet trading firms!

Trading Bonuses Fraud

According to the Terms and Conditions, the company offers bonuses that become a part of the deposit, securing the trading result. However, they are not available for withdrawal, nor is the profit, before reaching a required trading volume. This volume equals the bonus amount divided by 4 in lots.

If a client submits a withdrawal request before meeting the required volume, any profits made from bonuses will be removed, and the client can withdraw only the initial deposit.

If it sounds unfair, it’s because it is. It’s all part of Bullden’s trading scam.

Bullden Range of Trading Markets

Bullden broker offers the following trading instruments:

- Forex – EUR/USD, CAD/GBP, AUD/JPY

- Commodities – gold, corn, natural gas

- Indices – NIKKEI225, AUS200, DAX30

- Shares – Amazon, Facebook, Tesla

- Cryptocurrencies – BTC, ETH, ADA

Additionally, the firm claims to provide NFT trading, but we haven’t found this asset once we overviewed the platform.

What Is Known About Bullden’s Trading Conditions?

Bullden’s trading conditions are unregulated, as is the broker itself. T&C contains various hidden fees and malicious clauses, such as the one referring to bonuses. If you are thinking of investing with this firm, we advise you to read legal documents first. It’ll be enough to dissuade you.

About Leverage and Spreads

The spread is solid, standing at 0.4 pips for the EUR/USD pair. On the other hand, the leverage is fixed to 1:100. EU and UK regulators have set a limit of 1:30, while in the US and Australia, it’s fixed to 1:50. By offering higher leverage, this firm puts you at higher risk.

Bullden Minimum Deposit and Unfavorable Withdrawal Terms

According to the Account Types section, Bullden doesn’t have a minimum deposit requirement. Clients are free to deposit as much as they want. This may sound appealing, but it’s just a trick. Once you’re lured into investing, you won’t be able to withdraw your funds, thanks to different hidden terms.

Withdrawals are executed from the trading terminal, but terms are not specified. We know that the firm charges a fee of $50 for accounts inactive over 30 days.

What Payment Method Does the Broker Accept?

The company accepts only one payment method – cryptocurrencies. This is the least favorable option since crypto transactions are hard to follow, and funds are virtually unable to recover. You cannot claim a chargeback or recall the transfer. Thus, it’s an ideal tool for scammers such as Bullden.

Scammed by Bullden Broker? – Let Us Hear Your Story

If you find yourself a victim of a Bullden scam, let us know. It’s not the end, and there are ways to track and trace your funds.

Contact our recovery experts to book a free consultation, and we will evaluate your case thoroughly. Don’t let scammers keep your funds. Let’s fight together!