Fibofix is an offshore trading firm trying to confuse its investors about being based in Luxembourg. Since we know how schemes operate and what tricks they use, we can see right through it. Read our Fibofix review to find legitimate information.

| Broker status: | Offshore Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | fibofix.com |

| Blacklisted as a Scam by: | CSSF, CONSOB, FSMA, A-TVP |

| Owned by: | FiboFix Ltd |

| Headquarters Country: | St. Lucia |

| Foundation year: | 2020 |

| Supported Platforms: | WebTrader |

| Minimum Deposit: | $250 |

| Cryptocurrencies: | Available |

| Types of Assets: | FX, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | No |

| Accepts US clients: | No |

What About Fibofix Regulation?

Fibofix states that its main advantage is “compliance with global standards and reliable regulation.” However, this regulation is nowhere to be found.

The brand is owned by FiboFix Ltd, based in St. Lucia, with the alleged payment provider being Zex Systems Ltd from Luxembourg. We could not track this firm in Luxembourg, but we found the same-named office in the UK. It seems to be a shell firm made to cover for the Fibofix scheme, with Ukrainian as a director.

However, Fibofix is abusing the address in Luxembourg, making it the company’s official headquarters. As explained, the actual owner is in St. Lucia, and this firm has nothing to do with Luxembourg, the UK, or any other European country.

Why Is It Important For A Broker To Be Licensed?

Every broker should be licensed to provide legitimate financial services and ensure funds’ safety. Although Fibofix claims it operates according to reliable regulation, this Forex company is not licensed. Any funds you invest in are at tremendous risk.

In addition, we strongly advise you not to invest inDolfinIndex,BitnexLtdandFinexStockfraudulent brokers. So don’t fall for these dishonest scam brokers!

So Is Fibofix a Decent Broker or a Scam?

Fibofix is a scam trading broker. There’s an official warning in Luxembourg against the firm. The consumer index is 1, indicating that you should not trust the company.

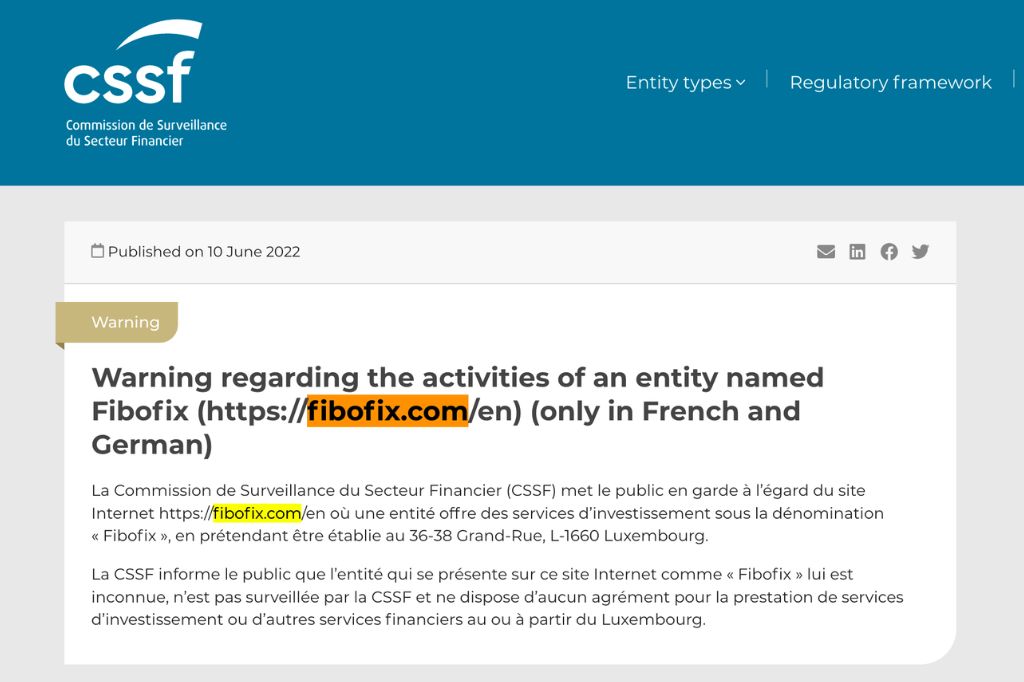

Fibofix Warning From Financial Regulator CSSF

As an official proof that Fibofix broker is not based in Luxembourg, we have a CSSF warning. The financial authority of Luxembourg claimed that Fibofix is an unregulated scheme firm.

The same warning was later republished by the Italian CONSOB, Slovenian A-TVP, and Belgian FSMA.

Traders Reviews About Fibofix

Of course, Fibofix reviews are mainly negative. Since the firm follows its own rules and not regulatory prerogatives, investors have been defrauded and without the possibility of getting a refund. According to the comments, if you dare to submit a withdrawal request. The broker employees will simply block your trading account.

If you recognize yourself in this story, you should file a Fibofix complaint immediately.

What Platforms Does Fibofix Offer? – Available Trade Software

Fibofix offers a simple WebTrader. It would be more suitable to say that it’s a TradingView chart with the attached indicators. The platform has no advanced features such as EAs and doesn’t support social trading. In fact, all you can do is check the offered assets and margin level and place a trade.

If you want to start trading, we will always recommend a legitimate firm providing you with MT4 or MT5. It won’t be an exaggeration to say that this software is hundreds of times more advanced and safer than any web-based tool.

All About Fibofix Accounts

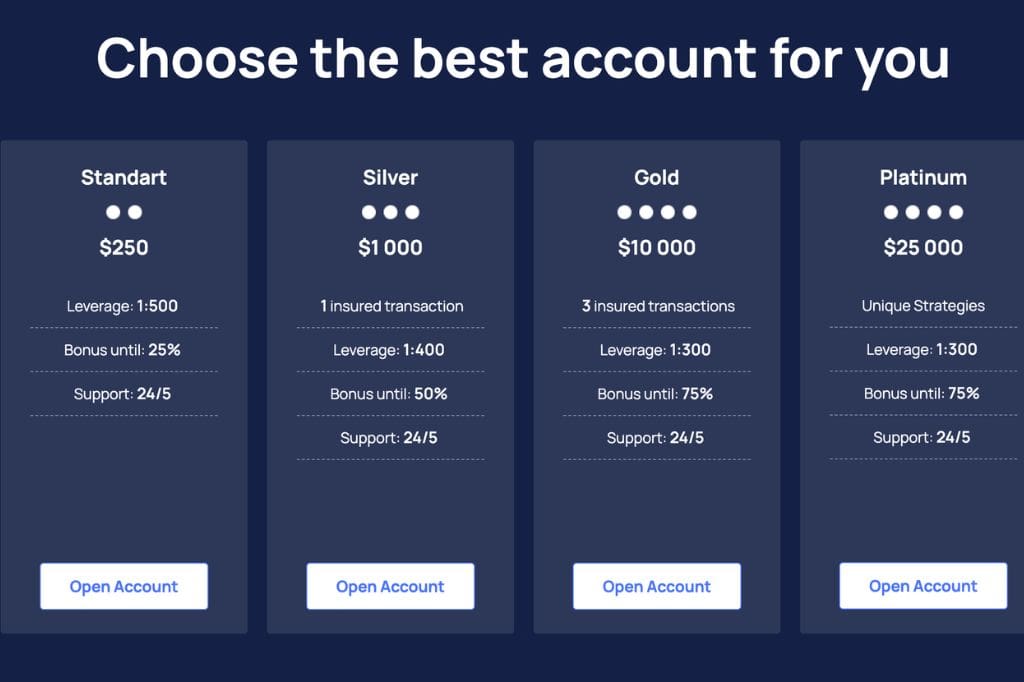

There are four brokerage accounts:

- Standart – $250

- Silver – $1,000

- Gold – $10,000

- Platinum – $25,000

The main difference is in leverage, bonuses, and so-called insured transactions. Some brokers will lead you to believe they have inside information about the market and can guarantee profits. This is not true, and it’s just a lure to upgrade your account and extort more money.

So, you should avoid Invest Flow forex broker and similar brokers such asTower Bridge,ROICraftandEmiDeals.

Fibofix Broker – Countries Of Service

Our research has shown that Fibofix broker mainly targets residents of Germany and Iceland. However, since we proved that the broker is not legitimate, it can operate anywhere without appropriate supervision. Wherever you reside, the safest is to decline any offers coming from Fibofix or similar offshore schemes.

Fibofix Range of Trading Instruments & Markets

The firm offers trading with the following instruments:

- Forex – EUR/USD, USD/JPY, GBP/USD

- Commodities – corn, oil, gas

- Shares – Tesla, Amazon, Facebook

- Indices – Nikkei225, DAX30, UK 100

- Cryptocurrencies – BTC, ETH

Fibofix Minimum Deposit

Fibofix broker is charging a standard initial deposit of $250. Yet, risking any money with a fraudulent firm blacklisted in several European countries is pointless. Instead of worrying if you will ever see a penny back, you can simply deposit with a legitimate firm. Most of them have Micro accounts starting with as low as $10. That way, you’re ensuring funds’ safety and saving yourself an unnecessary headache.

Trading Bonuses – Methods Of Fraud

The broker offers 25-75% bonuses on your initial deposit. However, no broker would give you anything without getting something in return. For instance, Fibofix has the following clause, “The funds in the Client’s trading account are available for withdrawal only after the Client completes the required trading turnover on his account.”

The turnover is equal to the bonus amount multiplied by the leverage. The leverage is 35 for bonuses under 50% of the deposit amount and 40 for bonuses above 50% of the deposit amount.

Note that regulators prohibited bonuses and other incentives since scam firms were abusing them to prevent clients from withdrawals.

Fibofix Trading Conditions

The firm offers a pretty low spread of 0.9 pips, but there are some hefty fees. In addition, the leverage is unregulated.

High Leverage

This trading company offers leverage varying from 1:300 to 1:500. Just for your information, regulators have set a strict limit of 1:30 for the Forex market and only 1:2 for crypto. Therefore, it’s further proof that the trading company cannot be licensed or legitimate.

Fibofix Deposit, Withdrawal Methods, and Fees

The company accepts the following payment methods:

- Debit/credit card

- Wire transfer

- Crypto wallet

Only credit cards provide you with a certain level of security since you’re entitled to a chargeback within 540 days.

Payment Method Of Legitimate Brokers

Legitimate investment firms offer clients to invest using e-wallets such as PayPal and Skrill. This method allows up to 21 days money-back period, which ensures safety. Since the firm doesn’t have this option, we advise you to use your credit card.

Scammed by Invest Fibofix Broker? – Let Us Hear Your Story

If you were scammed by Fibofix, it’s time to seek help. Our chargeback specialists will be more than happy to hear from you and help you find the best refund solution. Book your free consultation right away.

But What Is A Chargeback?

This is a way for your bank to recover stolen funds. Contact us via online chat, and we will book your consultation with experts. Let’s start the refund process as soon as possible and increase your chances of winning the dispute. Act now!