In the Finero Review, we proudly present to you the evidence necessary to condemn the wrongdoing of this fraud. The scammer known as Finero had its fun but now its days are numbered. After reading about the legal background, trading platform and conditions that this broker provides, you never return a single call again.

Also, remember the names of the Red Finance Capital, MarketsBank and Bitech Max trading scams and avoid them at all costs! Moreover, always check the background of online trading companies before investing!

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | finero.co.uk |

| Blacklisted as a Scam by: | Bank of Russia |

| Owned by: | Finero Ltd |

| Headquarters Country: | England |

| Foundation year: | N/A |

| Supported Platforms: | WebTrader |

| Minimum Deposit: | 250 USD |

| Cryptocurrencies: | Yes – Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Tether |

| Types of Assets: | Forex, Commodities, Crypto, Stocks |

| Maximum Leverage: | 1:300 |

| Free Demo Account: | Unavailable |

| Accepts US clients: | No |

Is Finero a Licensed Broker And How Reliable Is It?

Finero tried to conceal its true intentions by claiming it provides services in one of the most well-known markets in the world, i. e. the UK. With such status come strict rules that brokers must respect as well as severe penalties.

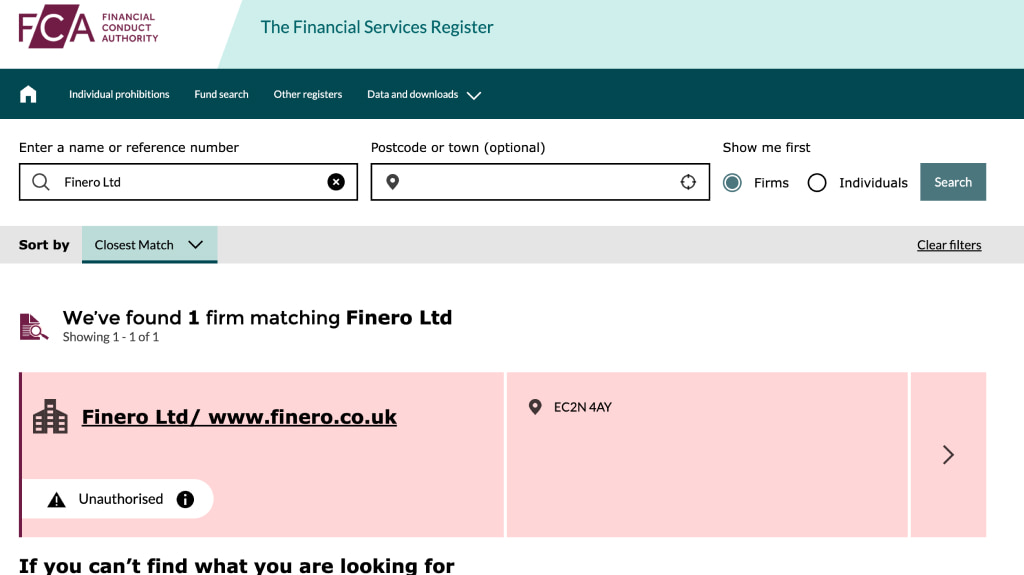

The reputable local regulator – the Financial Conduct Authority (FCA), is the one that dictates the game in the UK. Thus, its word is the law and if an entity fails to follow it, its operation is doomed. Since Finero provided a London address, let’s see what the FCA has on the dubious broker.

We thought so. Shame on you, Finero, for providing a fake license allegedly issued by the regulator. Moreover, we checked all the registration numbers on the website and still got nothing.

Some Reasons Why It Is Better To Trade With a Licensed Broker

If Finero were really eligible to provide services in the UK, it would have to have a minimum operating capital of GBP 730,000, to enable negative balance protection, an indemnification clause in place and store clients’ funds in a Tier 1 bank. Needless to say, our little fraudster skipped the essential criteria necessary for obtaining a license.

Is Finero a Legit Broker or a Scam?

Finero is an unlicensed and fraudulent scam brokerage that falsely claims to operate in the United Kingdom. The con artist mainly targets traders from the UK, Germany, Poland, Italy and Spain.

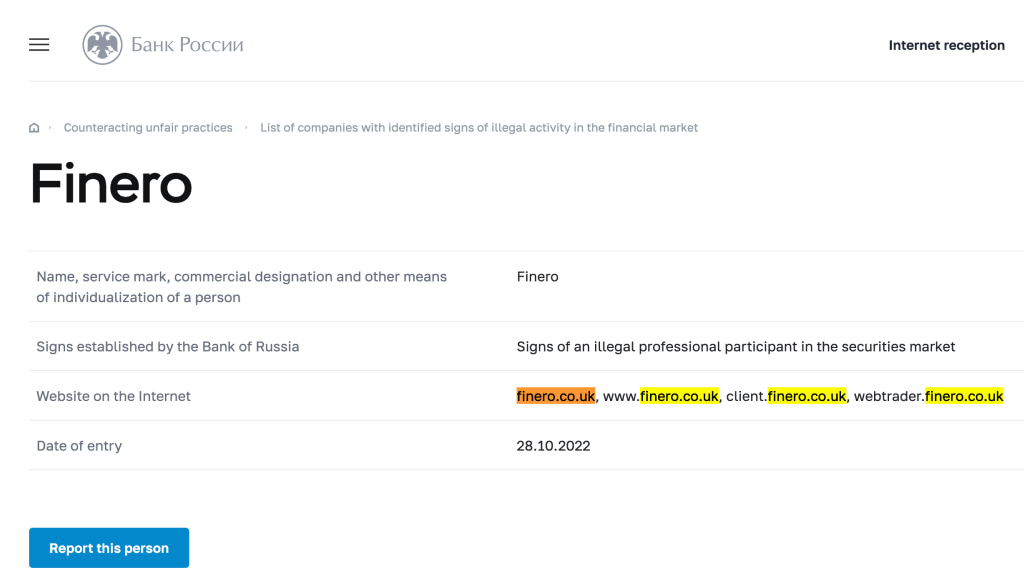

Warning from the Bank of Russia

Having debunked the nefarious lies about possessing a license, let’s continue to put Finero on blast. If you thought things couldn’t get any worse for the scammer, wait until you get a load of this. The fraudulent broker has been blacklisted by the Bank of Russia. Have fun trying to bail out of that one, Finero.

What Trading Software Does Finero Offer? – About Platform Reliability

Finero boasts about providing a platform that “has all the necessary tools, indicators and what a trader needs to make wise decisions.” Yeah, right. Where is it then? You cannot seriously be referring to WebTrader.

That browser-based platform is a far cry from efficient and convenient trading software. It lacks advanced features and tools such as automated trading and API integration. There’s no way your experience will be complete. Also, without a real license, the platform may as well be rigged all the way.

What Сan Be Traded? – Assets List

Here’re the assets that Finero allegedly offers:

- Forex pairs – EUR/USD, GBP/CAD, USD/AUD…

- Commodities – gold, silver, crude oil…

- Crypto – Bitcoin, Ethereum, Litecoin, Tether…

- Stocks – Lloyds Banking, Adidas, Apple…

What about indices? For some reason, the scammer omitted them. That’s a big drawback in our book.

What Are Traders Saying About Finero?

We couldn’t find many comments on Finero but that’s a good thing. It means the fraudster didn’t manage to deceive many traders, at least we hope not. Sometimes, a concise warning from a trader speaks volumes. Read aloud the ones below.

Hello, I was scamed by this company. I was persuaded to take a bank loan and pay PLN 42,000 to buy bitcoin. I also know about three other deceived people. Unfortunately the company’s website has disappeared. There is no contact, no money. I warn everyone against this company

Their domains was registered in three last months. One of them – by a Ukrainian. Contact phones are Polish and German numbers (when it’s located in London). Polish “account manager” aka scammer writes e-mails in poor Polish. Red flags and an alarm siren – scam as hell.

Where Does Finero Engage In Fraud? – Countries Of Service

Judging by the complaints and comments we posted, as well as our own research, we conclude that Finero mainly targets unsuspecting victims from the following countries:

- Germany;

- Italy;

- Poland;

- Spain;

- UK.

The phone numbers provided start with the Polish code +48, further solidifying our claims. The website is multilingual as well. If you’ve been contacted by this unscrupulous broker, reject everything you are offered without hesitation.

In addition to the above, we strongly advise you not to invest in Eurinvesting, SevenSeasFX and Shangquan fraudulent brokers.

What Do We Know About Finero Account Types?

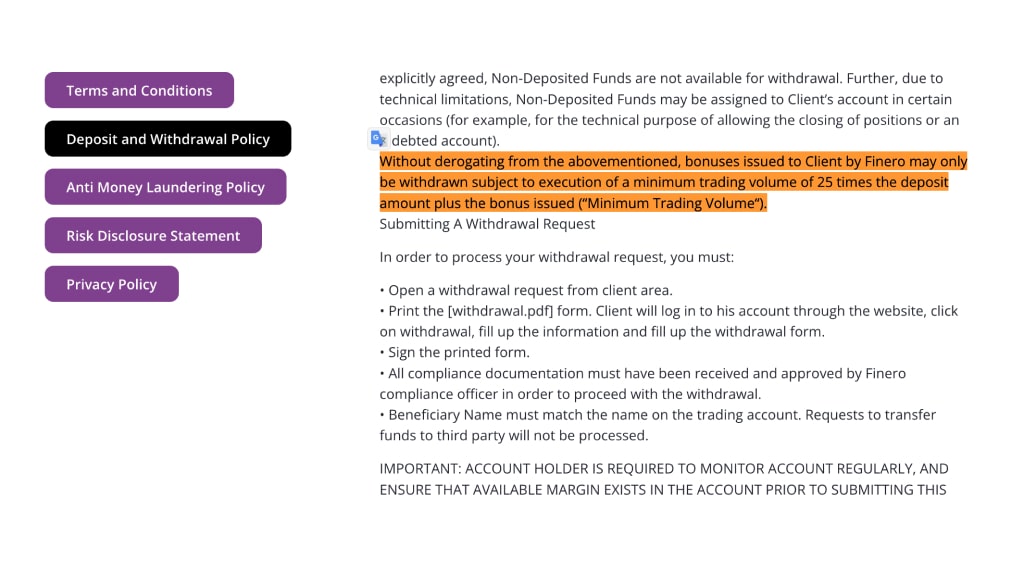

Finero offers six account types. We have to note that key aspects were not specified. Leverage, spreads & commissions. Oh well, at least the fraudster included bonuses, which happen to be banned by regulators.

- Basic – $250;

- Bronze – $2,500;

- Silver – $10,000, 10% bonus;

- Gold – $25,000, 20% bonus;

- Platinum – $50,000, 30% bonus;

- Diamond – $100,000, 30% bonus.

Can a Trader Open a Free Demo Account?

No. Finero just keeps playing itself down. Isn’t it suspicious that there’s no demo account? How are you supposed to know what you’re paying for? Every legitimate broker must offer one.

About Leverage, Spreads and Fees

We must admit, the spreads we got on the trading platform were amazing – 0.1 pips for EUR/USD! However, that does not change the fact that the broker is unregulated and still dangerous. Plus, the commissions were not disclosed and we bet they’re through the roof.

As for leverage, it caps at 1:300. That’s well above the legal limit of 1:30 for FX pairs prescribed by market authorities. When the market is volatile, such high leverage most often results in great losses, hence why it was prohibited.

High Minimum Deposit and Withdrawal Terms

The minimum deposit is $250, which is not that out of order per se, but we wouldn’t trust Finero with a dime. After going through the messy legal documentation, we found outrageous fees that the scammer imposes.

A whopping $50 for wire transfers, $25 for credit/debit card transactions, $25 for e-payments plus a $10 processing fee. On top of that, there’s also a 10% levy. Remember the pesky bonuses you get? Well, if you don’t trade up to an insanely high amount, you won’t be able to withdraw money.

Choice Of Payment Methods

The financial swindler claims to accept e-payments but hasn’t specified which e-wallets it rolls with. Nevertheless, we also have traditional methods – credit/debit cards and wire transfers. Finero is not interested in withdrawals as it probably doesn’t intend to allow any. All the scammer wants is that precious initial deposit.

Scammed by Finero Broker? – Let Us Hear Your Story

Don’t feel bad about being scammed. It’s awful but it could’ve happened to anyone. Con artists like this one take others’ kindness for weakness. What’s important now is to consider how to get your money back. We’re here to help you by telling you a bit more about chargebacks and recalls.

But What Is A Chargeback?

- A chargeback can be requested at the issuing bank within 540 days of the transaction.

- It is used to reverse credit/debit card transactions.

- For wire transfers, the same process is known as a recall.

- It will only work if the transaction hasn’t been completed.