OctexTrade has never listed its company owner or any relevant details. When it comes to headquarters, currently, the firm claims to be in the US. Before, it claimed to be in the UK when several EU regulators blacklisted it. Read our OctexTrade review and get all the information.

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | octextrade.com |

| Blacklisted as a Scam by: | AMF, CONSOB, FSMA, CMVM, A-TVP |

| Owned by: | N/A |

| Headquarters Country: | US (allegedly) |

| Foundation year: | 2021 |

| Supported Platforms: | N/A |

| Minimum Deposit: | $200 |

| Cryptocurrencies: | Available |

| Types of Assets: | FX, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | 1:30 |

| Free Demo Account: | Yes |

| Accepts US clients: | Yes |

What About OctexTrade Regulation?

OctexTrade is an anonymous investment brand. We have no relevant information besides the alleged headquarters. However, the firm claims to be regulated by the UK FCA, Australian ASIC, and South African FSCA.

Many unregulated firms claim the same. They believe that investors won’t bother to check the accuracy if they see several different regulations. Well, we did. And upon checking, we confirmed that OctexTrade is an unregulated scheme.

Why Is It Important For A Broker To Be Licensed?

Any trading firm has to have a license so that it can provide legitimate financial services. Tier1 regulators, among which the UK FCA and the Australian ASIC, ensure that Forex firms have compensation funds to reimburse potential victims.

Since we already discovered that OctexTrade regulations are fake, your funds are not protected.

In order to add to the above, we strongly advise you not to invest in fraudulent brokers FXrally, Profitrade247 and Invest Union LTD.

So Is OctexTrade A Decent Broker Or A Scam?

OctexTrade is a scam broker. The company claims to be based in the US, yet it has no financial regulations. The consumer rating is 1 and there are several regulatory warnings, indicating that customers were scammed by this investment firm.

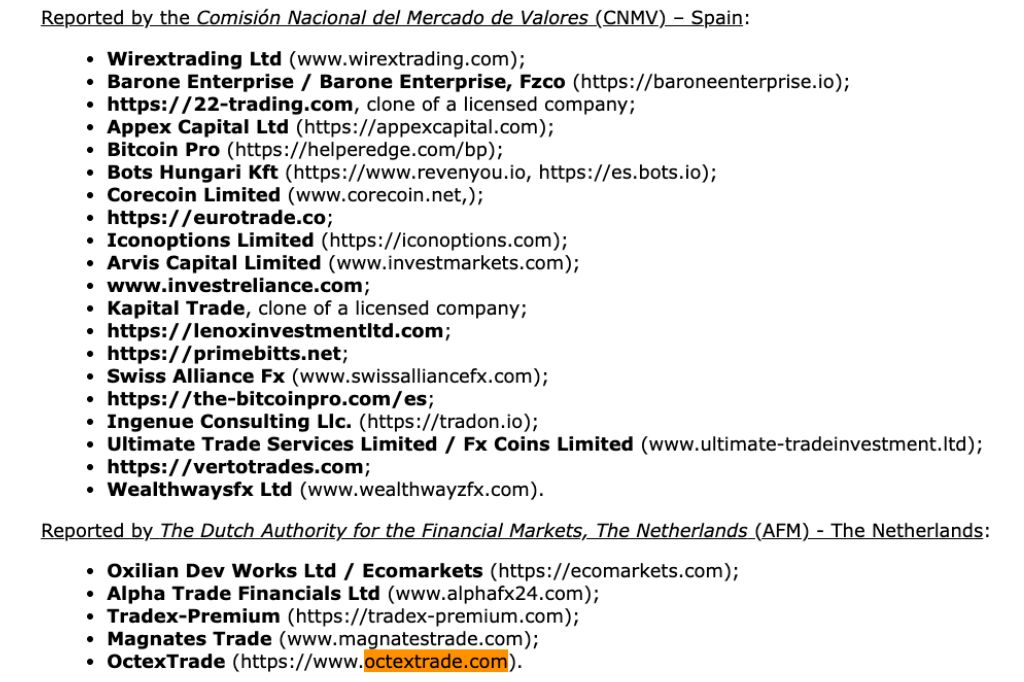

OctexTrade Warnings From Financial Regulators

OctexTrade was blacklisted by the Dutch regulator AMF. In this warning, AMF stated that this brokerage is a suspected boiler room without a license and urged investors to avoid it.

The same warning was later republished by the Italian CONSOB, Belgian FSMA, Portuguese CMVM, and Slovenian A-TVP.

Traders Reviews About OctexTrade

Let’s say that OctexTrade won’t get an award for the favorite broker. Investors have written many negative reviews describing their experience with the firm. The main accent is on the inability to withdraw funds since OctexTrade employees are doing anything in their power to dissuade investors and block their investment accounts.

What Platforms Does OctexTrade Offer? – Available Trade Software

Well, here we come to a significant issue. Any investment firm ought to provide traders with a functional trading platform. It’s a primary tool to place trades and make a profit. Upon signing up for the OctexTrade Demo account, we were provided with a TradingView chart. And it’s a literal chart, without a possibility to open and close any trades. Buy and Sell buttons are inactive, meaning that this is just an imitation of trading software.

We always advise investors to choose a regulated firm offering MT4 or MT5.

All About OctexTrade Accounts

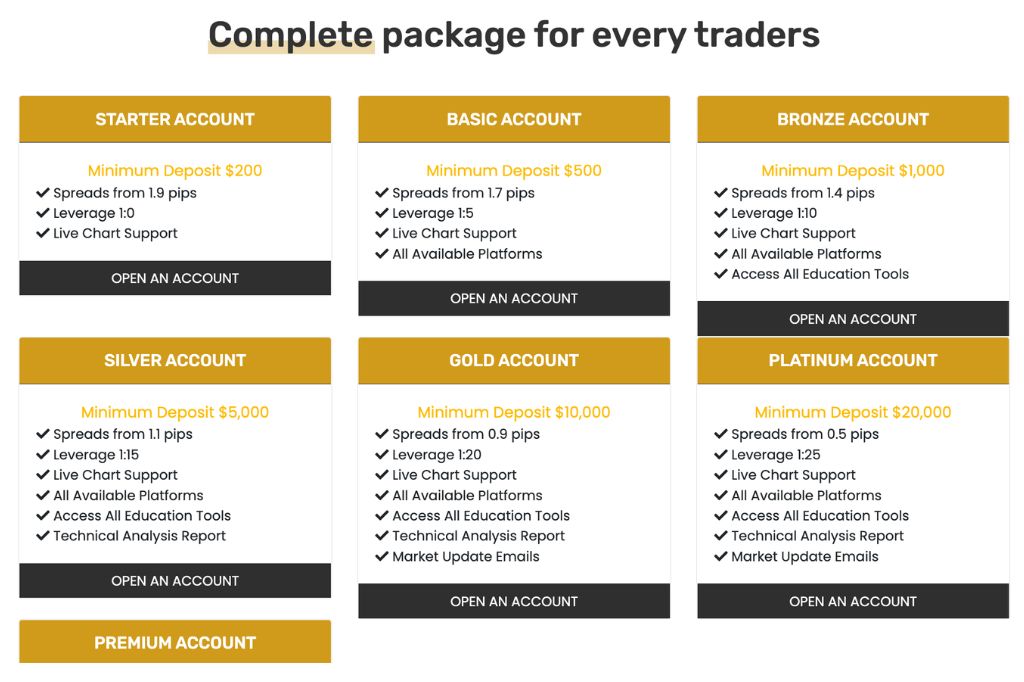

The broker has 7 different account types, including:

- Starter – $200

- Basic – $500

- Bronze – $1,000

- Silver – $5,000

- Gold – $10,000

- Platinum – $20,000

- Premium – $30,000

Accounts differ in leverage, spread, commissions, and access to different educational tools.

Demo Account

In theory, OctexTrade has a Demo account. But, as already explained, there’s no platform to place any trades.

OctexTrade Broker – Countries Of Service

The main targets of OctexTrade broker are residents of the Netherlands, the US, and the UK. Since the firm is unregulated and claims to have various licenses, it means it’s targeting many countries. Wherever you are, note that you should avoid OctexTrade broker.

OctexTrade Range of Trading Instruments & Markets

Technically, clients should gain access to:

- Forex market – EUR/USD, USD/JPY

- Commodities – gold, natural gas, Brent oil

- Indices – NASDAQ, Dow Jones

- Shares – Apple, Amazon, Tesla

- Cryptocurrencies – BTC, ETH, XRP

However, without a platform, you cannot trade.

Please, also remember the names of DakkenGroup, FinsRoyal and FundsProMax scams and avoid them at all costs! Also, always check the history of online trading companies before investing!

Minimum Deposit – High Initial Investment

This company requires a minimum of $200 to start trading. Yes, it’s lower than many brokers request. Still, legitimate firms with Micro accounts let you start with as low as $10. Therefore, there’s no reason to give $200 to a company with fake regulations and without a platform.

OctexTrade Trading Conditions

When it comes to trading conditions, we see several problems. First of all, the spread starts at 3.3 pips, which is double higher than average. It means that investing with this broker is quite pricey. Furthermore, the Payments section indicates that you will be charged certain fees, but nothing is specified.

Regarding leverage, the broker tried to play regulated and allowed up to 1:30, complying with the regulatory requirements.

OctexTrade Deposit, Withdrawal Methods, and Fees

Clients can make deposits and withdrawals using debit/credit cards and wire transfers. The broker claims it can take up to 45 business days for wire transfer withdrawal to be processed. This is completely untrue, and no bank will take over a month to process your money.

In the end, here’s a scam clause:

“There’s a withdrawal fee charge for all investors account depending on the type of account you operate; you’re charged before a withdrawal is approved.”

There are no specifications about how much you will be charged, which means it’ll be according to the broker’s will.

Payment Method Of Legitimate Brokers

Legitimate trading firms allow you to use safe payment methods, such as PayPal and Skrill. With these, you have a guaranteed period during which you can request a refund.

Since it’s not an option with OctexTrade, we advise you to use your credit card. That way, you have up to 540 days to file a dispute for a chargeback if something goes wrong.

Scammed By Invest OctexTrade Broker? – Let Us Hear Your Story

If you were scammed by OctexTrade, let us know. Our chargeback specialists will assist you in finding the best method to recover your funds.

But What Is A Chargeback?

This is a way for your bank to recover the funds from the merchant if you can prove that you have been a scam victim. Contact us via online chat to book a free consultation and get more details about this procedure.