We’ve already dealt with this sort of scammers before. Thus, catching this fraudster red-handed was not difficult. Now, the most important thing is to convey this information to newbie traders and protect them from the scheme. That’s why we wrote the Red Finance Capital Review. Enjoy!

In addition to the above, we strongly advise you not to invest in MarketsBank, Bitech Max and CMTPRO fraudulent brokers.

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | redfinance.capital |

| Blacklisted as a Scam by: | FCA, ASF, CNMV |

| Owned by: | Shenanigans Consulting LTD |

| Headquarters Country: | St. Vincent and the Grenadines |

| Foundation year: | 2022 |

| Supported Platforms: | WebTrader |

| Minimum Deposit: | 250 USD |

| Cryptocurrencies: | No |

| Types of Assets: | Forex, Commodities, Indices, Shares |

| Maximum Leverage: | 1:100 |

| Free Demo Account: | Unavailable |

| Accepts US clients: | No |

Is The Broker Red Finance Capital Legitimate?

This crooked financial swindler is anything but legitimate. First of all, it is operated by an offshore entity known as Shenanigans Consulting LTD, based in St. Vincent and the Grenadines. That lonely little island is home to numerous scams due to its tax system.

Also, the local regulator – the Financial Services Authority (FSA), does not issue Forex licenses. It’s even stated on the website. Therefore, any hopes of Red Finance Capital of deceiving the public have just been crushed!

Some Reasons Why It Is Better To Trade With a Licensed Broker

- Trading with a licensed broker implies that you have negative balance protection in case your balance hits zero;

- Your funds are stored in a segregated account in a Tier 1 bank;

- If the broker goes bankrupt, you have considerable indemnification;

- The FX provider must have a minimum operating capital (i. g. GBP 730,000 in the UK);

- Red Finance Capital is NOT regulated by any authority!

So Is Red Finance Capitalal Decent Broker or a Scam?

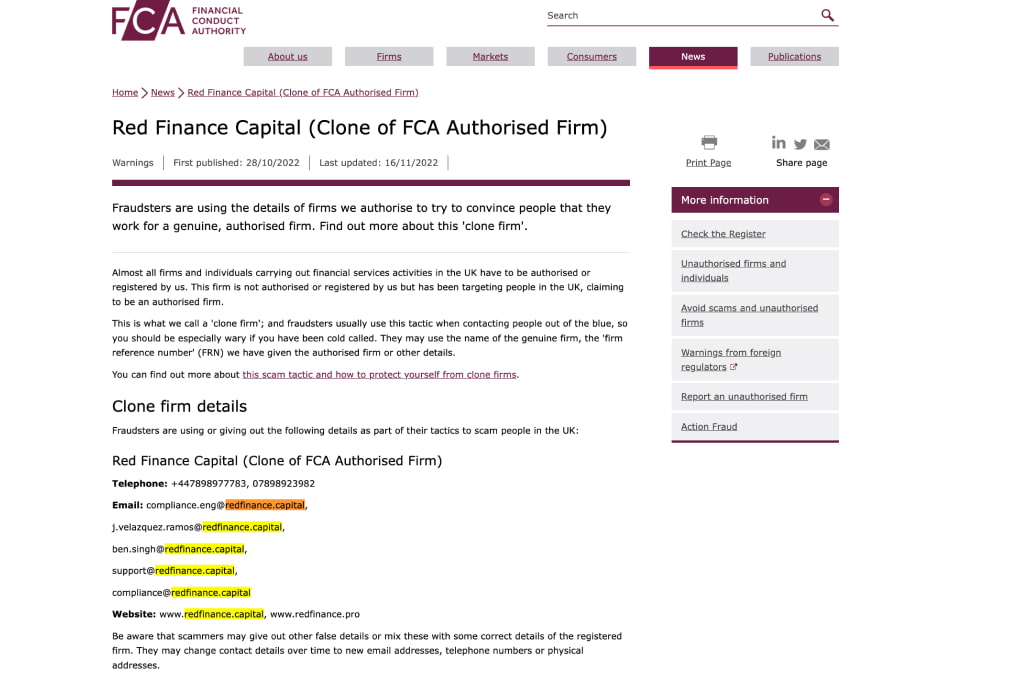

Red Finance Capital, a dangerous provider engaged in fraudulent activities, is actually a clone of an FCA-authorized company. The scam broker mainly targets traders from the UK, Canada, Spain and Germany.

Warnings about the Clone Website from the FCA and other Regulators

The UK’s rigid financial market body – the Financial Conduct Authority (FCA) has issued an unequivocal warning against Red Finance Capital. The authority states that this fraudulent entity is a clone of an authorized company – Red Finance Limited.

Furthermore, the Romanian ASF and Spanish CNMV have also blacklisted the fraudster’s owner company. Check it out:

What Trading Software Does Red Finance Capital Offer? – Platform Reliability

Similar to most stranded offshore tricksters, Red Finance Capital offers a basic WebTrader platform. This browser-based terminal has only elementary features, i. e. simple charts and indicators.

It lacks advanced tools and options that approved platforms like Meta Trader 4 & 5 offer such as automated trading, live-market reports and API integration. Plus, the web platform is oftentimes being manipulated by the scammer to steal your money without you knowing.

What Сan Be Traded? – Assets List

Red Finance Capital claims to offer the following assets:

- Forex pairs – EUR/USD, USD/JPY…

- Indices – S&P500, US100, DOW30…

- Commodities – crude oil, natural gas, gold…

- Shares – Apple, Google, Visa…

We’re not surprised this phony took the instruments from TradingView and posted them as its own. Anyone can do that. Without a license, nobody knows whether you’ll actually get all these instruments.

What Are Traders Saying About Red Finance Capital?

We checked a few reviews on Trustpilot and found alarming confessions. It seems the financial swindler has already defrauded some unfortunate traders. Thankfully, these victims spoke out against the con artist. Be sure to read their comments below.

Stay off this company of you can

Stay off this company of you can, they have swindled me to bits drained me and it took extra efforts and involvement of Almaxsolutions’ team legal stand off to get all 18,000 retrieved back for me, they sent an email with notice of account closure after the retireval yesterday, note that hey have stopped responding since October, no replies and the calls are never answered until they were forced to return all my money, stay clear of them.

– Trustpilot Customer

Total Scam

Don’t do anything with this company and people. They have you deposit 250 USD and in no time it shows you have thousands in your account, but then if you want the money they scam you out of more money in “Fees”. As soon as they said I had to open a NDAX account and deposit half the amount in my trading account with was a bit over 3000, so I’d have to put 1500 in the NDAX account in order to get my money I knew it was a scam. I’m lucky they only got the initial 250 from me. Do not get involved with these people.

– Trustpilot Customer

Negative Balance Protection

Negative Balance Protection is a phenomenal feature to have while trading. In case something goes wrong, at least you won’t be overdrawn. For a broker to cover you, it must have substantial capital, as the regulator prescribed. Red Finance Capital, however, does not provide that since it is unlicensed, despite claiming that it does.

Referral Program

In its essence, the referral program is just a hoax. It entices you to invite friends by offering hefty rewards and bonuses. What you’re really doing is pulling more innocent people into this vile scheme. Therefore, ignore this deceitful concept at all costs.

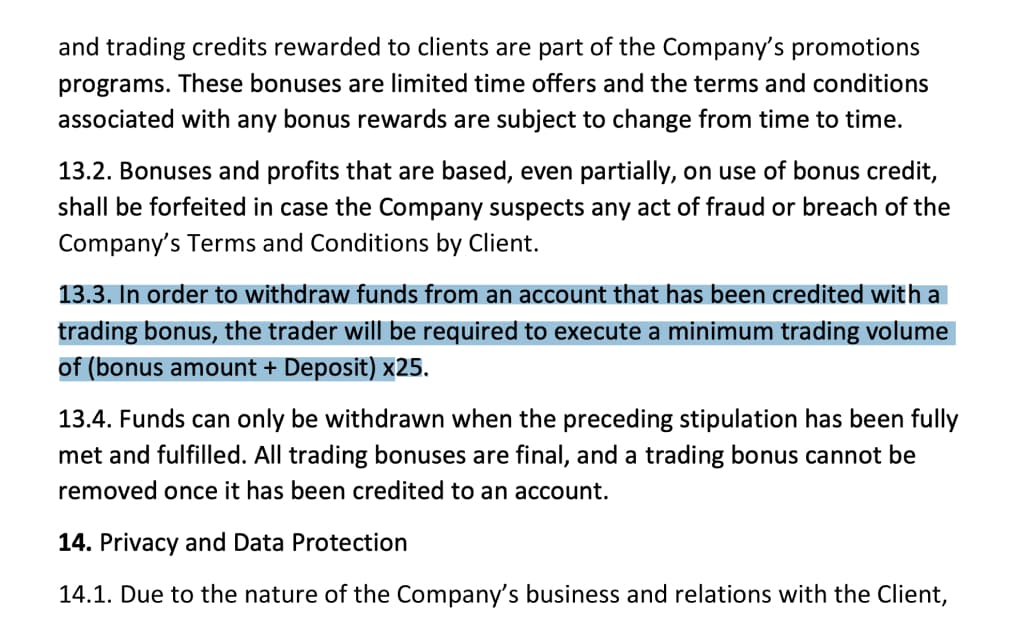

Can I Withdraw My Deposit Bonus?

Ah yes, bonuses. Did you know that top-tier regulators banned bonuses? If you’re wondering why’s that, take a look at the following clause. These fake promises always come with strings attached.

Red Finance Capital – Countries Of Service

Judging by the reviews we’ve read, as well as additional research, the malevolent scammer is selective regarding victims. It does use the same tricks that frauds are known for but not with the same traders. So, we’ve made a list of countries where Red Finance Capital likes to spit its venom. If you reside in any of them, beware!

- UK;

- Canada;

- Spain;

- Germany.

Also, remember the names of the ETF Corp, Equalpros and XTB Global trading scams and avoid them at all costs! Moreover, always check the background of online trading companies before investing!

What Do We Know About Red Finance Capital Account Types?

When it comes to Red Finance Capital’s account types, there’re four of them:

- Mini – $250, leverage up to 1:30, 100 available assets;

- Standard – $5,000, 1:50, 500 assets;

- Classic – $25,000, 1:80, 100 assets;

- VIP – $50,000, 1:100, 500 assets.

The fraudster is really taking clients for fools. The standard acc offers 500 assets but the classic 100?! Also, the minimum deposits are way too high and risky for such an illicit provider. It’s best you stay away.

Can a Trader Open a Free Demo Account?

No. Surprised? We surely aren’t. A demo account is necessary to give insight into a broker’s platform and conditions. Without it, you’re going in blind and you have to pay up. See the problem?

About Leverage, Spreads and Fees

Red Finance Capital claims that spreads start at 1 pip, i. e. borderline competitive. However, on the platform, we received 3 pips, which is just too wide. Allegedly, all trading is commission-free, but we don’t trust the scammer one bit.

As for the leverage, you should know that the legal limit in the UK and EU is 1:30 for FX pairs. For US and Canadian clients, it’s 1:50. Our cyber fraudster’s leverage caps at 1:100, exceeding the prescribed limit by quite a margin. At such high leverage, the risks will eat you alive!

High Minimum Deposit and Withdrawal Terms

The minimum deposit is $250. As for the fees, they exist but were not disclosed. We were left in the dark there. When dealing with an outright scammer like this one, nothing is certain anymore.

Choice Of Payment Methods

Red Finance Capital listed two acceptable payment methods – credit/debit cards and wire transfers, i. e. the traditional ones. If you ask us, that’s not very professional.

Legitimate brokers also include e-payments (Skrill, Neteller, etc.) and cryptocurrencies. Withdrawal requests allegedly take 4-7 working days to process. However, we doubt that’s the case.

Scammed by Red Finance Capital Broker? – Let Us Hear Your Story

If you’ve been scammed by Red Finance Capital, that’s unfortunate. We feel for you. But, it’s important to try to get a refund. We know two ways you could accomplish that but you have to act fast! Ever heard of a chargeback or a recall?

But What Is A Chargeback?

- A chargeback is the reversal of credit/debit card transactions.

- You can request it at the issuing bank within 540 days.

- A recall is used to reverse wire transfers, also performed by the issuing bank.

- In order to work, it has to be requested before the completion of the transaction.